owner draw quickbooks s-corp

This article describes how to. The funds are transferred from the business account to the owners personal bank.

Quickbooks Owner Draws Contributions Youtube

Manage More Of Your Business All From One Place With Best-In-Class Apps.

. Business owners might use a draw for compensation versus paying themselves a salary. Create a personal Other Asset account. As an S-Corporation suddenly you have a choice to make every time money leaves the companys hands and gets into yours.

Heres the work around Im using. S-corp does not have equity draw and investment accounts there are shareholder accounts that can not be used the same way as the equity draw and investment are in non. Example 1.

An owners draw is an amount of money an owner takes out of a business usually by writing a check. I named mine Businesses - MY BUSINESS NAME with my actual business name of course. Pros of an owners draw Owners draws are flexible.

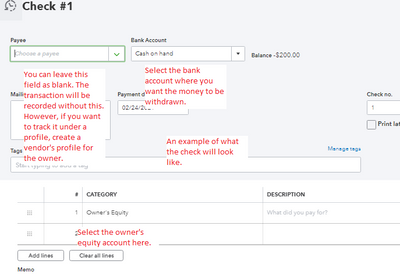

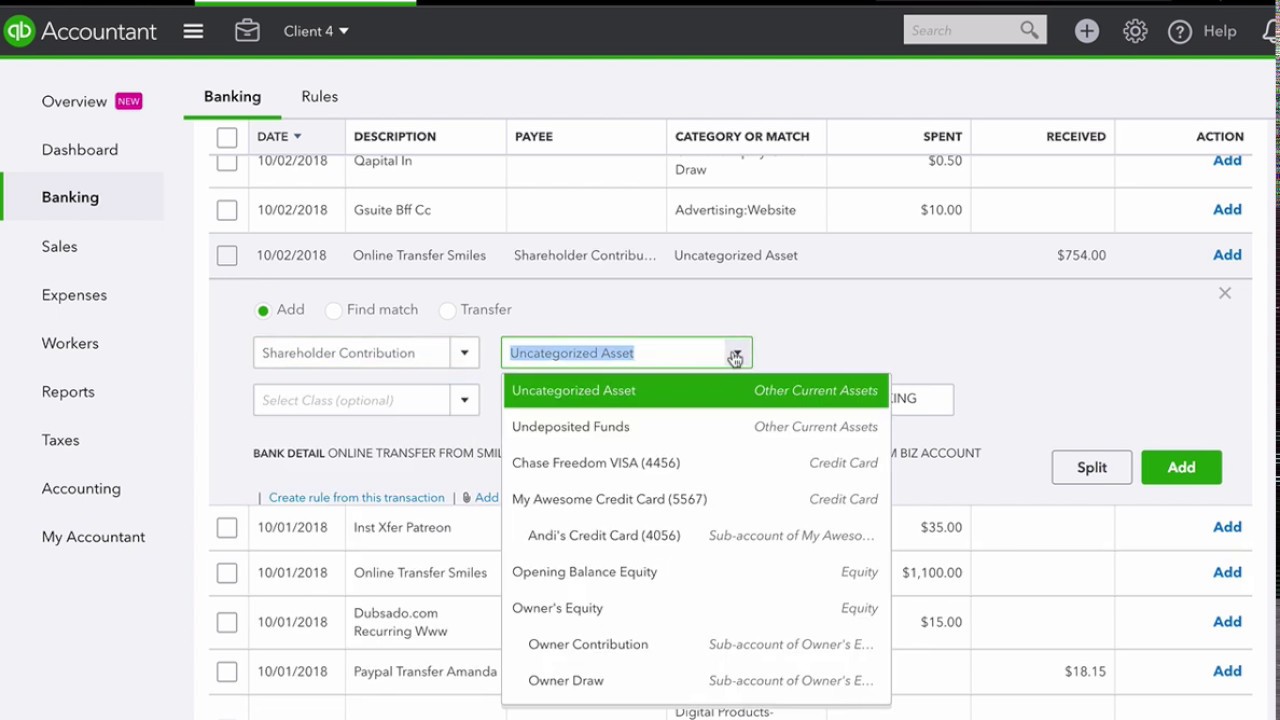

Owners draws can be scheduled at regular intervals or taken only. This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. An owners draw also known as a draw is when the business owner takes money out of the business for personal use.

An owners draw gives you more flexibility than a salary because you can pay yourself practically whenever youd like. Once done click Save and. 2 The employeesowners ie.

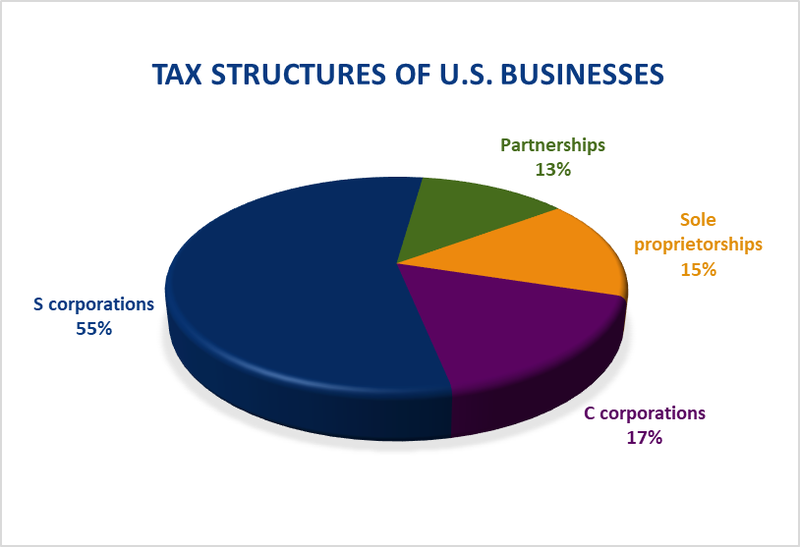

Just a few problems with your understanding C-Corps. Manage More Of Your Business All From One Place With Best-In-Class Apps. An owners draw is a separate equity account thats used to pay the owner of a business.

Only a sole proprietorship a partnership a disregarded entity LLC and a partnership LLC can have owner draws. An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary. S-corp does not have equity draw and investment accounts there are shareholder accounts that can not be used the same way as the equity draw and investment are in non.

Make the check payable to you. According to IRS internal system those corporations that are elected to share. Also known as the owners draw the draw method is when the sole proprietor or partner in a partnership takes company money for personal use.

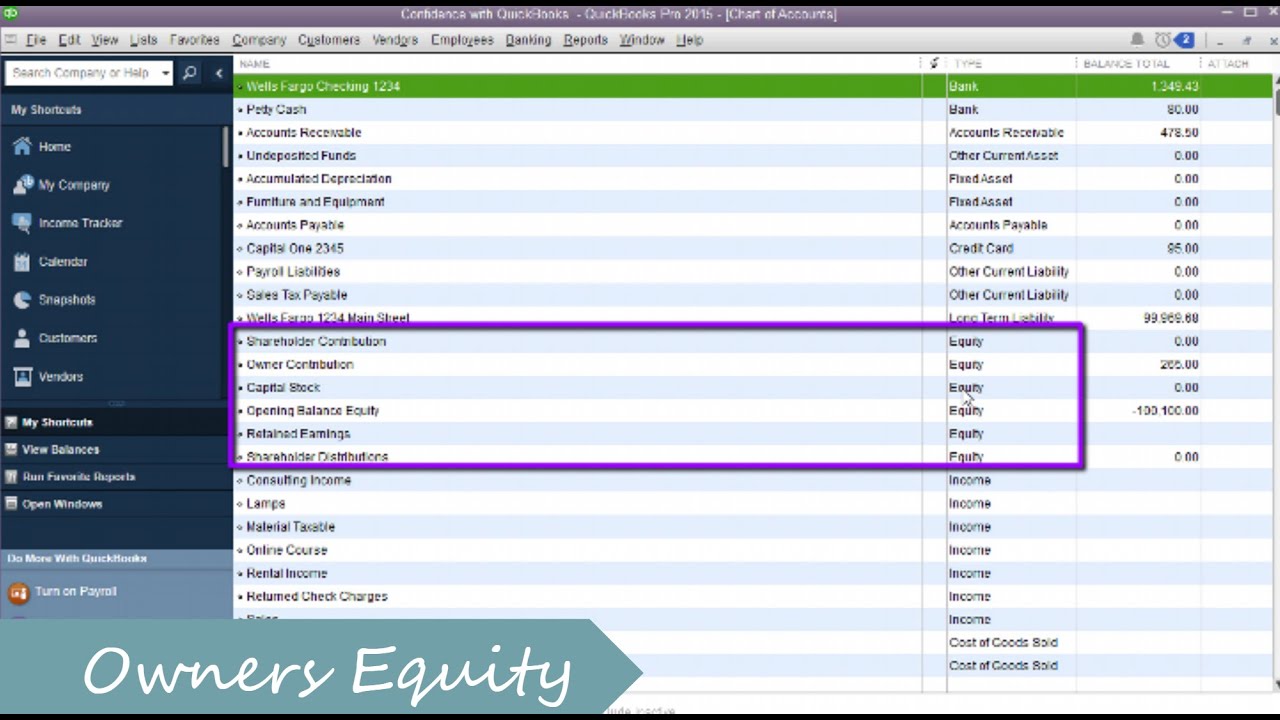

Is it a draw or a salary. A is also Ss president and only employee. Owners draws are usually taken from your owners equity account.

S generates 100000 of taxable income in 2011 before. Instead you make a withdrawal from your owners. Ad Create Simplify And Automate Workflows When You Integrate Your App Data.

Pros The benefit of the draw. Ad Create Simplify And Automate Workflows When You Integrate Your App Data. Make sure you use owners contributionsdraws.

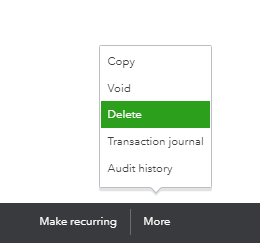

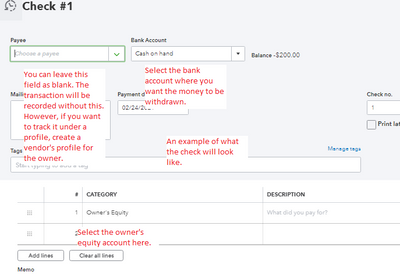

1 They dont have owners. If you have QuickBooks record this payment the same way you would a regular check as if you were paying bills. Under Category select the Owners Equity account then enter the amount.

An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner. A draw lowers the owners equity in the business. When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures the money is treated as a draw on the.

Being a business owner there is no need to confuse between corp and s corporations. An owner of a sole. The account to charge.

Add other details of the check such as reference number memo etc. A owns 100 of the stock of S Corp an S corporation.

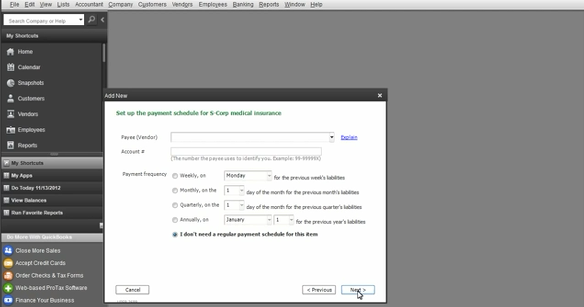

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

Pin By Sarah Alexander On Business Bookkeeping Business Small Business Bookkeeping Small Business Finance

S Corporations Vs Llc Example Of Self Employment Income Tax Savings My Money Blog

Do Owner Draws Count As Salary For The Paycheck Protection Program Bench Accounting

Benefits Of Owning An S Corp Taking Distributions

Quickbooks Chart Of Accounts For Contractors Small Corporation S Corp Desktop Bundle Fast Easy Accounting Store

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

Solved S Corp Officer Compensation How To Enter Owner Eq

S Corp Vs C Corp Which Is Right For Your Small Business The Blueprint

Solved S Corp Officer Compensation How To Enter Owner Eq

How Can I Pay Owner Distributions Electronically

Llc Vs S Corp Which Is The Best For Freelancers Financial Fitness Business Structure Business Tax

6 Essential Words To Understanding Your Business Finances Small Business Bookkeeping Budgeting Finances Small Business Finance

Solved S Corp Officer Compensation How To Enter Owner Eq

How To Setup And Use Owners Equity In Quickbooks Pro Youtube

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

How To Categorize Shareholder Distributions And Contributions In Qbo Youtube