working capital funding gap in days

According to a recent working capital practices study of the manufacturing and distribution industry 161. Then current liability other than bank borrowings is 80-2060.

Working Capital Cycle Definition How To Calculate

Ad Working capital supply chain finance advice from leading industry experts.

. Funding From 5K-500K In As Little As 24 Hours. Days in the period. Ad Compare 2022s Best Working Capital Loans.

456 Days in the period. Ad QuickBridge Working Capital Loans. Average requirement 20000 45000-200002 32500 Finance cost 5 x 32500 1625.

Change In Working Capital Video Tutorial W Excel Download A working capital formula determines the financial health of the. 456 Days in the period. It can be shown as.

If the poor collection procedures cause the working capital requirement to increase beyond the available facilities then the business will simply run out of cash. Apply Now Get Guaranteed Low Rates. Thus a higher days working capital figure means that a firm will require more days to realize cash from its working capital.

345 Payable days. Ad Working capital supply chain finance advice from leading industry experts. Management teams should do the groundwork first to optimise the working capital cycles of their businesses putting in place processes and protocols to drive responsibility and accountability for delivering against target working capital metrics.

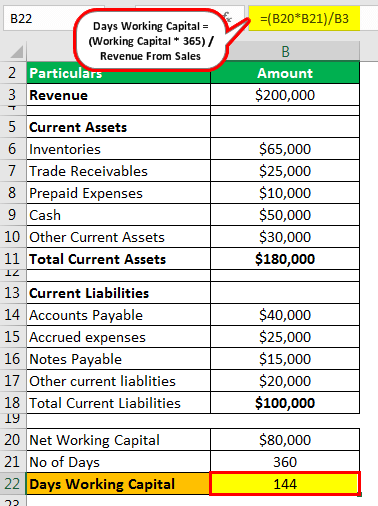

Not only is there an opportunity cost associated with extended credit sales but you incur interest for financing the loan to your customer. This ratio measures how efficiently a company is able to convert its working capital into revenue. Net Working Capital 80000.

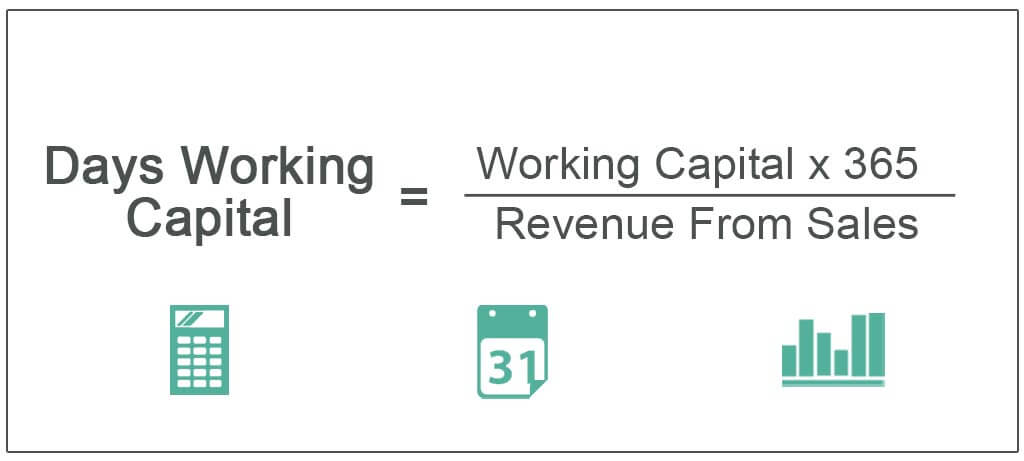

Days working capital states the number of days required for a business to convert its working capital into cash. Current assets minus current liabilities are equal to the Working capital gap. For instance if your supplier terms are 30 days and your customer terms are 60 days you will have a cash flow gap to fill with some form of working capital financing.

Days working capital 73 days. By substituting 90 days instead of 45 days in the formula used above the working capital requirement doubles to 45000 or 247 of revenue. It shows how long cash is tied up in the companies working capital.

Funding Up to 500K For Your Business. Here in the above example as we can see the days working capital is 126 days which denotes the company can recover its total invested working capital in 144 days. Working capital gap Current assets current liabilities other than bank borrowings For exampleCurrrent if current asset is 100 and current liabilities is 80bank liability is 20.

A firm that requires fewer days to do so has a reduced need for financing since it is making more. The days working capital is calculated by 200000 or working capital x 365 10000000. Since cost of sales was 718 it had to finance 6318000 for each day of its cash gap.

The number of days it takes for a company to turn its resource inputs into cash. Days Working Capital Net Operating Working Capital Average Daily Sales. 365 413 361 583 329 Based on the information below how much does the company need to finance the working capita funding gap and how much is the lender willing to provide.

472 Inventory days. The companys working capital would equal 200000 or 500000 - 300000. Working Capital Days Receivable Days Inventory Days Payable Days.

A funding gap is the amount of money needed to fund the ongoing operations or future development of a business or project that is not currently provided by. Whats the companys working capital funding gap in days based on the information below. Now lets understand how to calculate days of working capital with an example.

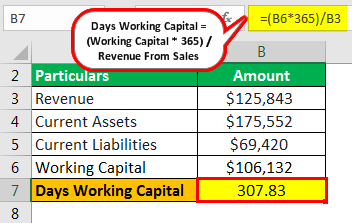

Calculation of Days Working Capital. 35 Funding gap days Revenues Days in period Cost of goods sold 365 1600000 2500000 Balance Receivables. The cash conversion cycle measures.

It can also be described as Long term sources few long term uses. Shaving just one day off the cash gap would add more than 400000 to. See why working capital management is no longer only a treasury function.

The working capital gap is. In plain terms the working capital deficit is the difference between total liquid assets and total equity other than bank liabilities. The days working capital is calculated by 200000 or working capital x 365.

Days Working Capital 157500 102740 153. Take balance sheet excerpts of ABC Ltd which has annual revenue of 37500000. Working Capital Gap.

Average working capital performance parameters across the SP 1500 companies 20122020 in average number of days Source. According to a recent working capital practices study of the manufacturing and distribution industry 161 percent of accounts receivable are still in the bush 180 days after the sale is made. The higher the number of days the longer it takes for that company to convert to revenue.

If the company borrowed money at 7 it paid 442288 in interest for each day in its cash gap. This will help provide clarity in terms of any residual funding gap that may need financing. Days of Working Capital Calculation and Example.

Even if the terms are equal there could still be gaps or delays between the time an expense incurred needs to be paid and when the revenues related to the incurred expense get collected. The Cash Conversion Cycle CCC of the SP 1500 companies lengthened by 63 days in 2020 representing the biggest increase in nine years largely due to a rise in inventory levels.

Working Capital Cycle Understanding The Working Capital Cycle

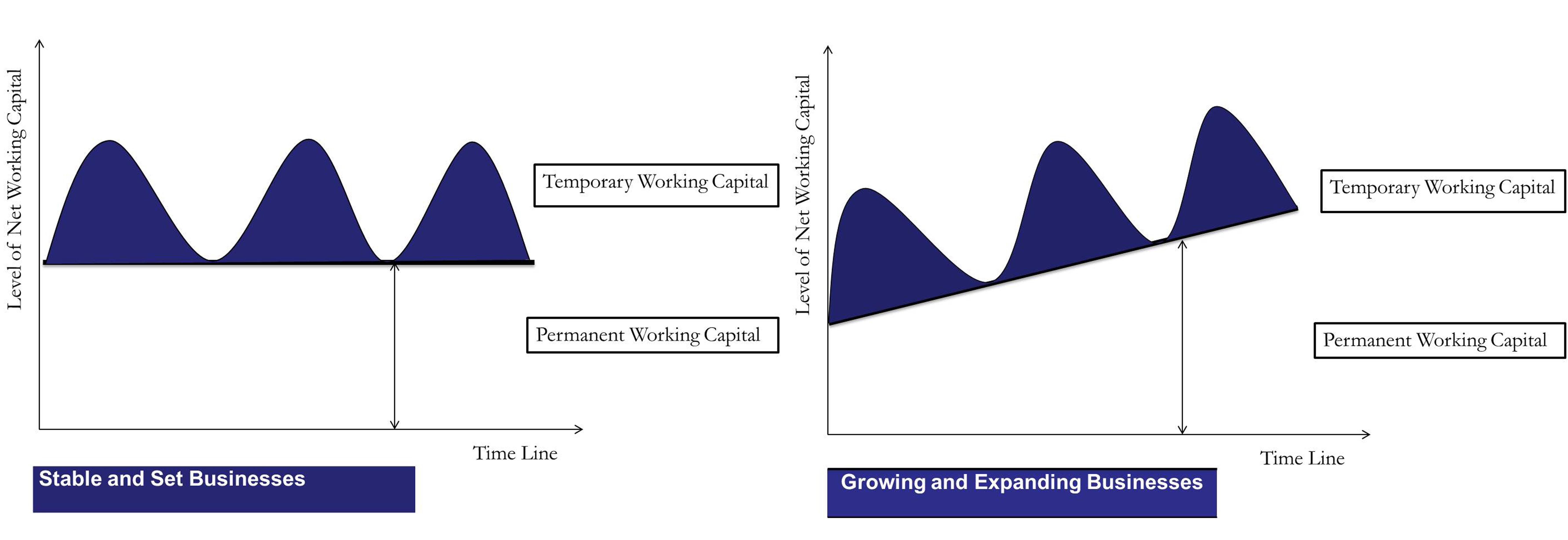

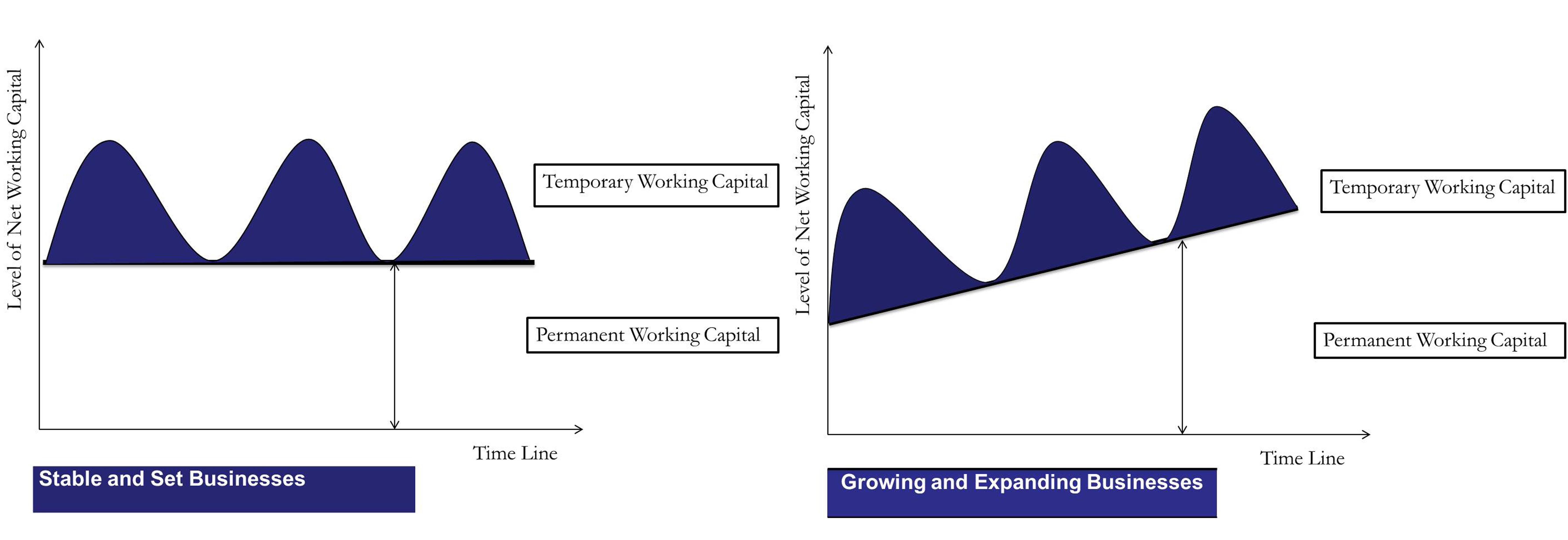

Types Of Working Capital Gross Net Temporary Permanent Efm

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Cycle What Is It With Calculation

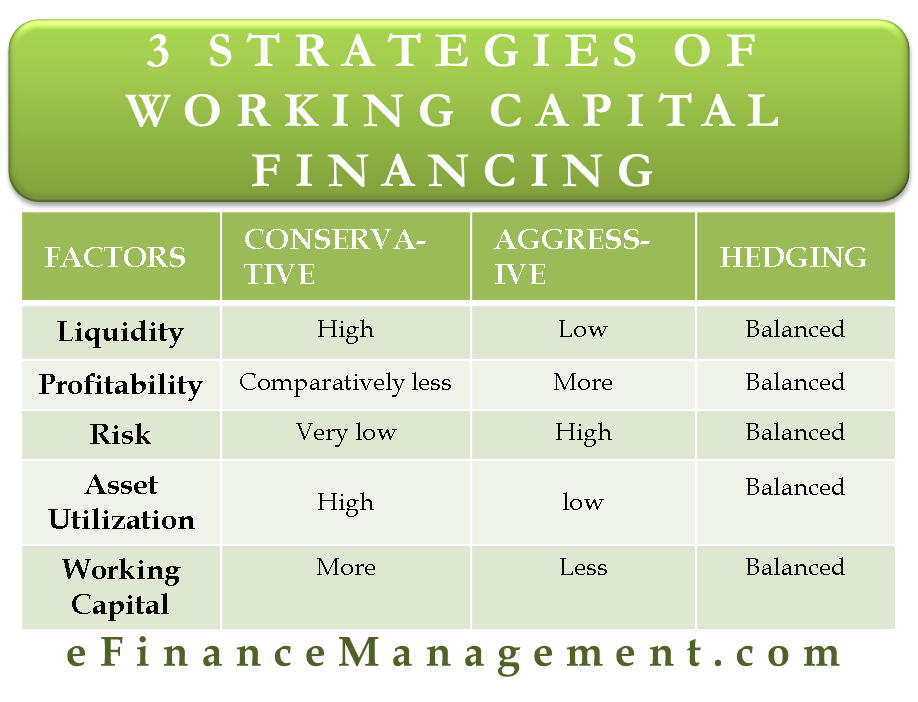

Compare 3 Strategies Of Working Capital Financing

Permanent Or Fixed Working Capital

Cash Conversion Cycle Ccc Formula And Excel Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

What Is Working Capital Gap Banking School

Working Capital What Is Working Capital Youtube

Method For Estimating Working Capital Requirement Financial Life Hacks Accounting And Finance Learn Accounting

Days Working Capital Definition Formula How To Calculate

Days Working Capital Definition Formula How To Calculate

Working Capital Cycle Understanding The Working Capital Cycle

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

Days Working Capital Definition Formula How To Calculate

Everything You Need To Know About Working Capital